- CAN I GO TO JAIL FOR GIVING A FAKE BANK STATEMENT PASSWORD

- CAN I GO TO JAIL FOR GIVING A FAKE BANK STATEMENT FREE

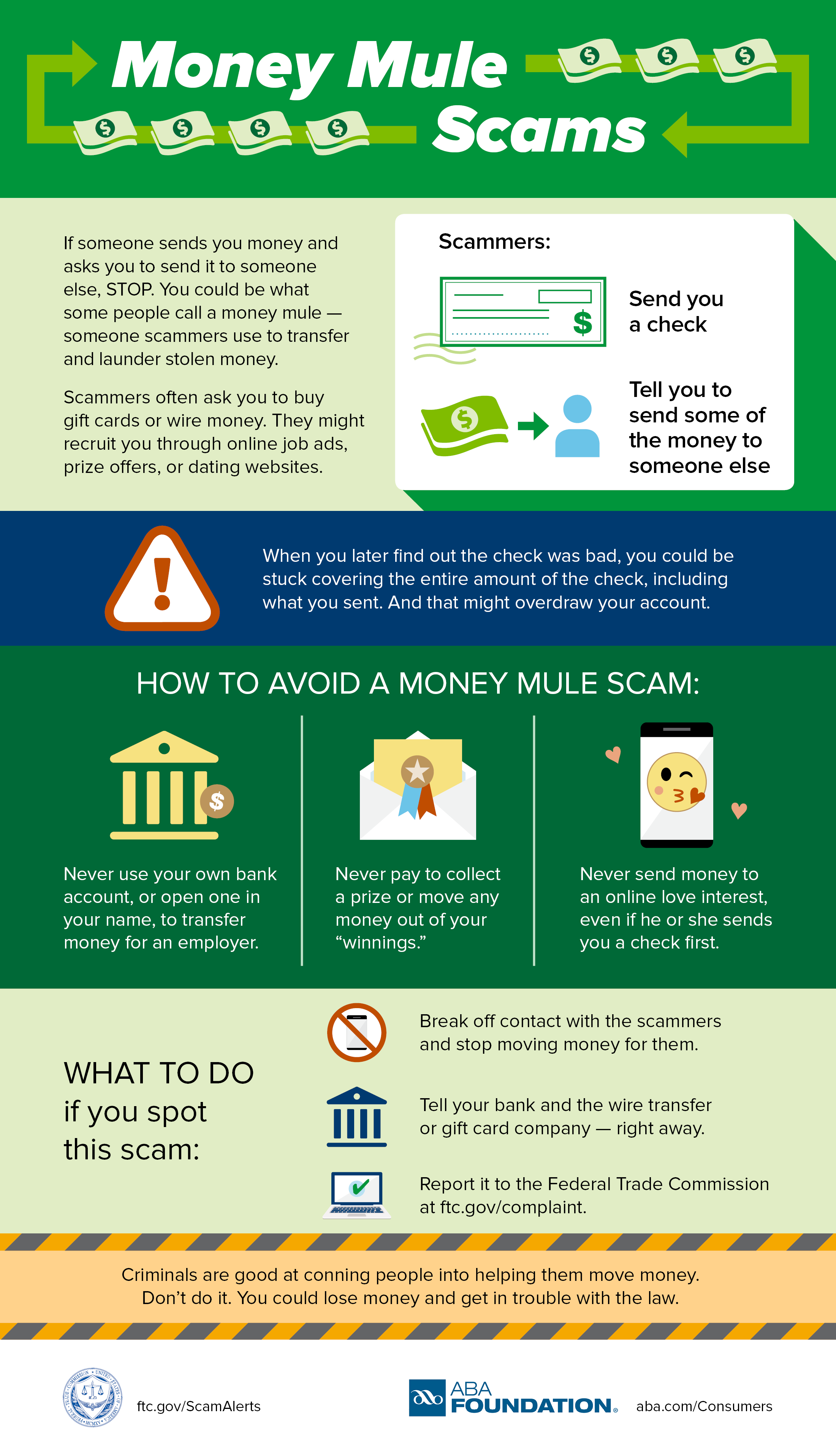

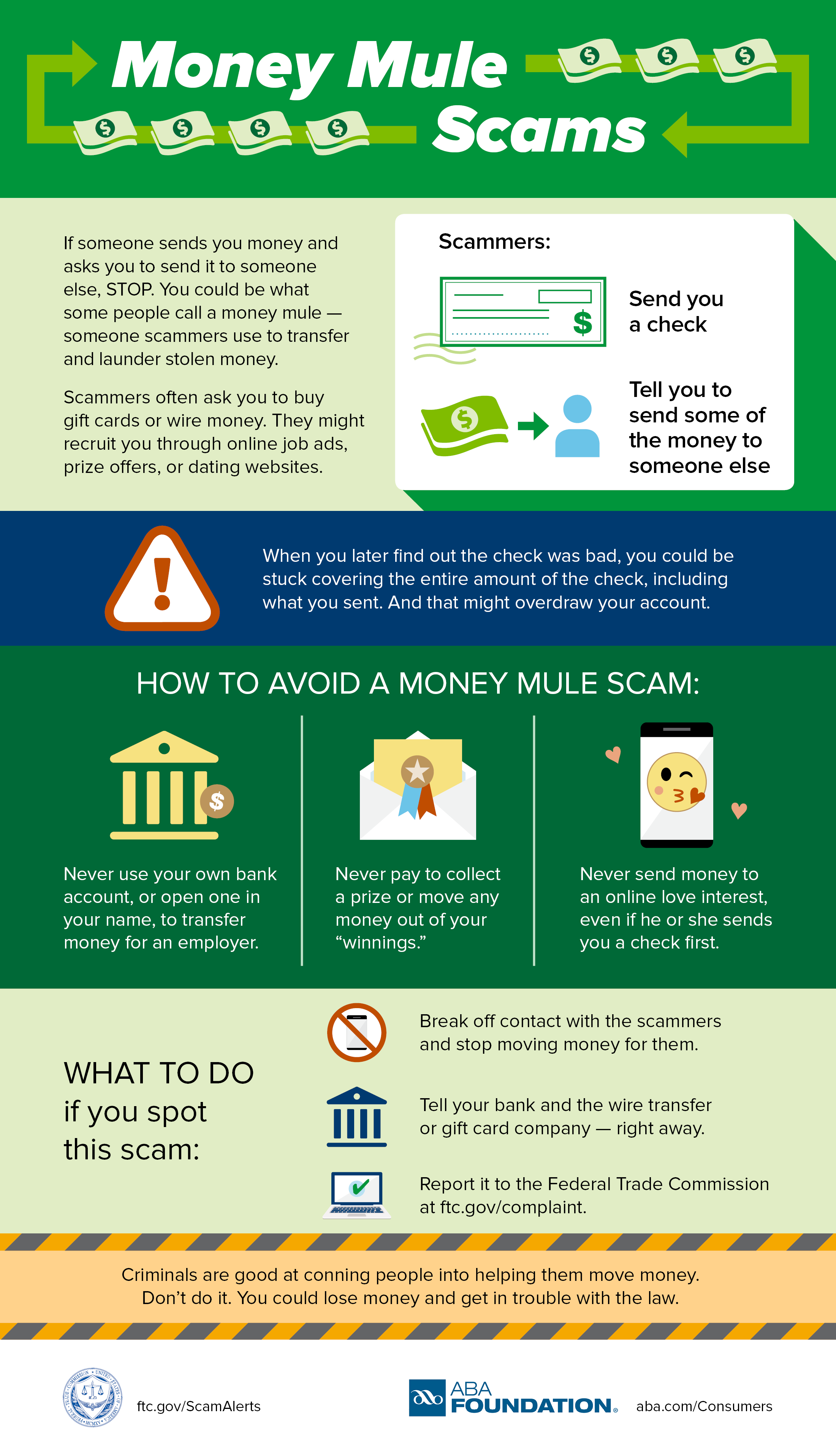

What is Check Washing?Ĭheck washing scams involve changing the payee names and often the dollar amounts on checks and fraudulently depositing them. Have you ever sent a check that was cashed, but the recipient said it never arrived? You may be the victim of check washing. November Security Tip Check Washing - What is it and how can I protect myself? Neither the government, law enforcement, Amazon, the IRS, nor any other legitimate entity will ever ask you to pay for anything by reading them gift card codes, or by sending cash in the mail!.If it sounds too good, or too bad to be true, it probably is! Be wary of anyone contacting you for any reason requesting return of funds, or telling you to send or deposit funds to another account.

CAN I GO TO JAIL FOR GIVING A FAKE BANK STATEMENT PASSWORD

For example, if you want to use your high school mascot or pet’s name a password or security question, make sure you’re not posting that detail on Facebook!

Be discerning about what you post on social media. For example, if you’re a Patriots fan, you could shorten the phrase “Former Patriots quarterback Tom Brady has six Superbowl rings” to “FPqTBh6$r” by taking the first letter of each word, and substituting the “s” for a “$”. A passphrase takes an easy sentence and shortens it down to a unique password. Passphrases are a good way to create complex, but easy to remember passwords. Avoid: Dictionary words (even with slight variations, like “Pa$$word”), pets names and other information that can be gleaned from social media. Use complex passwords that will be easy to remember, but difficult for a fraudster to guess. Change online banking and email passwords frequently and if not recently changed, now is a good time. Do not reuse passwords across applications, websites or social media. This serves as an extra layer of security against account takeover. Your branch or the CSC can assist with this. Create a personal profile password for your accounts with Washington Trust. The alert remains in place for 7 years, and will require banks to contact you at the method you specify in the alert, prior to granting credit in your name. The credit bureaus will require documentation from you to verify the claim of ID theft, including the police report mentioned above. Contact the credit bureaus to place an extended fraud alert on your credit bureau. Report any suspicious activity promptly to the relevant institution(s). Monitor your financial accounts daily for unauthorized transactions, even ones you don’t regularly use. CAN I GO TO JAIL FOR GIVING A FAKE BANK STATEMENT FREE

Consumers can request a free copy of their credit report from each of the 3 major credit reporting agencies (Equifax, Experian and TransUnion) one time every 12 months through the website

Review credit reports for unauthorized inquiries or accounts. Recommendations for mitigating the impact of fraud and identity theft: The guidance below contains best practices when faced with this type of situation. Make sure to print and save a copy for yourself.īecause your information has been used to file a fraudulent claim for unemployment, you will now be at higher risk to be targeted for fraud in other ways. This report will also feed to the RI Department of Labor and Training. This will prove valuable in the event of future ID theft attempts and will be necessary to unwind any fraudulent accounts opened in your name now or in the future. If you’ve been targeted in a fraudulent unemployment claim, first file a police report with the Rhode Island State Police. In recent months, many Rhode Islanders have also had fraudulent unemployment claims filed in their names. Minutes matter when you’re trying to recover lost money, so don’t wait! Make sure to report any fraud immediately to your bank, to local police, and to the Post Office if you’ve sent cash or other valuables through the mail. If you’ve been targeted in a scheme like this, talk to your friends and warn them what to look for you could be the one standing between them and the loss of their life savings. Don’t allow yourself to be pressured into acting quickly or overlooking red flags for fraud.

Review credit reports for unauthorized inquiries or accounts. Recommendations for mitigating the impact of fraud and identity theft: The guidance below contains best practices when faced with this type of situation. Make sure to print and save a copy for yourself.īecause your information has been used to file a fraudulent claim for unemployment, you will now be at higher risk to be targeted for fraud in other ways. This report will also feed to the RI Department of Labor and Training. This will prove valuable in the event of future ID theft attempts and will be necessary to unwind any fraudulent accounts opened in your name now or in the future. If you’ve been targeted in a fraudulent unemployment claim, first file a police report with the Rhode Island State Police. In recent months, many Rhode Islanders have also had fraudulent unemployment claims filed in their names. Minutes matter when you’re trying to recover lost money, so don’t wait! Make sure to report any fraud immediately to your bank, to local police, and to the Post Office if you’ve sent cash or other valuables through the mail. If you’ve been targeted in a scheme like this, talk to your friends and warn them what to look for you could be the one standing between them and the loss of their life savings. Don’t allow yourself to be pressured into acting quickly or overlooking red flags for fraud.

If you or a loved one are contacted by someone pressuring you to send them funds, or to act as a middle man to transmit funds to someone else, pause, talk to a trusted advisor such as a friend, family member or your bank. They take advantage of people’s anxiety, fear and uncertainty to carry out their schemes, even going to the point of showing up at local residents’ houses to extort cash from victims. Scammers have become even more bold and aggressive in the months since the COVID-19 pandemic began. Wilbur, CFE, Vice President, Corporate Security Governance Officer, The Washington Trust Company December Security Tip Financial Scammers Becoming More Aggressiveīy Jared B.

0 kommentar(er)

0 kommentar(er)